XRP Price Prediction: Will It Reach $3 Amid Technical and Fundamental Crosscurrents?

#XRP

- Technical Breakout Potential: XRP needs to clear the 20-day moving average at $2.96 to build momentum toward $3

- ETF Catalyst Impact: SEC filings and high approval odds provide fundamental support for price appreciation

- Critical Support Monitoring: The $2.74 Bollinger Lower Band must hold to maintain bullish structure and avoid sharp declines

XRP Price Prediction

XRP Technical Analysis: Key Levels to Watch

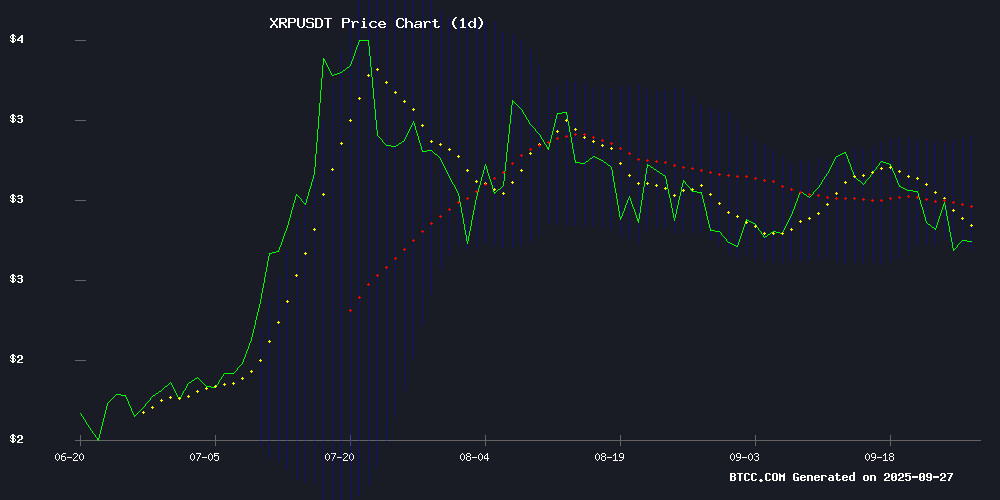

XRP is currently trading at $2.7843, below its 20-day moving average of $2.9617, indicating potential short-term resistance. The MACD shows bullish momentum with a positive histogram of 0.0846, suggesting upward pressure. Bollinger Bands place immediate resistance at $3.1786 and support at $2.7449, creating a critical trading range.

According to BTCC financial analyst Olivia, 'XRP needs to break above the 20-day MA to target the $3 psychological level. The current technical setup shows consolidation with bullish potential if key resistance levels are breached.'

Market Sentiment: Mixed Signals Amid ETF Speculation

Recent news highlights conflicting sentiment around XRP. Positive developments include Cyber Hornet's SEC filing for an XRP ETF and Uphold's bullish $1,000 price prediction, while concerns emerge about Remittix competition and potential sharp declines.

BTCC financial analyst Olivia notes, 'The ETF speculation and technical correction completion provide bullish catalysts, but traders should monitor the critical support levels mentioned in recent analyses. The 99% ETF approval odds contrast with warnings about diminishing relevance, creating uncertainty.'

Factors Influencing XRP's Price

Cyber Hornet Files With SEC for ETF Offering Exposure to XRP

Cyber Hornet ETFs has taken a significant step toward launching an innovative investment product by filing with the U.S. Securities and Exchange Commission. The proposed ETF aims to provide exposure to XRP alongside the S&P 500, blending cryptocurrency with traditional equity markets.

The September 26 submission marks the firm's latest attempt to secure regulatory approval for an XRP-focused exchange-traded fund. This move signals growing institutional interest in digital assets as viable components of diversified investment strategies.

Uphold Sparks XRP Frenzy With $1,000 Price Prediction

U.S. cryptocurrency exchange Uphold has reignited speculation around XRP's potential, suggesting the asset could surge 35,200% to reach $1,000. The platform posed a hypothetical scenario to its social media followers, asking how they would respond to such a price milestone.

The tweet echoes recurring bullish sentiment within the XRP community, though such projections remain highly speculative. Market observers note that achieving this valuation would require unprecedented adoption drivers and regulatory clarity for the embattled asset.

Analyst Identifies Critical Support Level for XRP to Sustain Bullish Momentum

XRP faces a pivotal moment as market analysts pinpoint a crucial price threshold that must hold to preserve its bullish trajectory. The digital asset has mirrored the broader cryptocurrency market's downturn, enduring sustained selling pressure in recent weeks.

Technical analysts emphasize that breaching this identified support level could invalidate the current optimistic market structure. The warning comes amid heightened volatility across crypto markets, with traders scrutinizing key levels for major assets.

Expert Foresees Major Developments for XRP

Prominent XRP community figure Cryptoinsightuk has signaled imminent significant news for the digital asset. In a recent social media post, the analyst prompted followers to speculate on potential U.S.-related developments, though specifics remain undisclosed.

The cryptic announcement comes amid heightened anticipation within the XRP ecosystem, with traders scrutinizing regulatory and institutional adoption signals. Market participants are weighing the implications of undisclosed developments that could influence XRP's valuation and market positioning.

XRP Completes ABCDE Correction, Double-Digit Rally Potential Intact

XRP has concluded its ABCDE wave correction on the daily chart, signaling the end of a consolidation phase rather than a sharp downturn. Crypto analyst Dark Defender notes the token's current position diverges fundamentally from previous cycles in 2017 and 2021, with key support levels now established between $3.33 and $2.64.

"The case for XRP is stronger than ever," Dark Defender asserts, pointing to accelerating adoption and utility as differentiating factors. While bearish indicators persist, demand appears sufficient to absorb selling pressure. The analyst emphasizes that respect for support levels could pave the way for double-digit price movement, though stresses this constitutes market education rather than financial advice.

XRP Price Faces Pressure as Remittix Emerges as Potential Competitor

XRP's price trajectory for 2025 remains uncertain, with analysts predicting it may struggle to surpass $2 amid growing competition from Remittix. The token currently hovers near $2.75, having dropped nearly 10% during the recent market correction. Technical indicators show oversold conditions with an RSI near 30, but resistance at $2.65–$2.70 continues to challenge recovery efforts.

Remittix, priced at just $0.1130 after raising $26.7 million, is gaining traction as a potential 'XRP 2.0' in global payments. Its focus on utility beyond speculation positions it as a formidable alternative. While XRP could rebound to $3.20 if it holds $2.70 support, failure may see it drop to $2.20 or lower by year-end.

XRP Price Holds Key Support as BlackRock ETF Speculation Grows

XRP maintains its position near $2.80 after repeatedly defending the $2.70 support level in recent weeks. Market participants are closely watching this technical threshold, which has proven resilient against multiple tests since August. A sustained hold above this level could pave the way for a move toward $3.20.

Technical indicators present a mixed picture. The Relative Strength Index sits near 40, signaling weak demand, while the Moving Average Convergence Divergence shows signs of stabilization—suggesting selling pressure may be abating. Analysts note potential for a retest of the $2.50-$2.55 zone based on fractal patterns and on-chain data revealing clusters of buyer activity.

Institutional interest emerges as a potential catalyst. A BlackRock executive recently discussed evaluation criteria for a potential XRP ETF, citing client demand, market capitalization, and liquidity as key factors. The cryptocurrency enters its third compression phase since the November 2024 elections, with market participants awaiting Franklin Templeton's ETF decision on November 14.

XRP ETF Approval Odds Surge to 99%, but Expert Predicts Diminishing Relevance

XRP is back in the spotlight as speculation grows around a potential SEC approval for a Ripple-backed ETF. Prediction platform Polymarket now shows a 99% chance of a 2025 launch, signaling overwhelming market optimism. Yet Flare Network co-founder Hugo Philion offers a contrarian view: "ETFs will be irrelevant within five years."

The current ETF frenzy, driven by older generations' preference for traditional investment vehicles, masks a generational shift. Millennials and Gen Z investors increasingly favor direct blockchain ownership—a trend Philion believes will accelerate amid mounting economic pressures. Unfunded liabilities and sovereign debt crises may force faster adoption of on-chain finance than institutions anticipate.

While Wall Street celebrates crypto ETFs as the ultimate adoption signal, the real revolution lies beyond these regulated wrappers. The market's fixation on short-term approvals overlooks the tectonic shift toward self-custody and decentralized finance infrastructure.

XRP Price Projection and Mining Opportunities Gain Traction

XRP is capturing market attention as analysts forecast a potential surge beyond $30 by 2026, with some targets reaching $34. This optimism stems from a combination of technical patterns resembling a 'double bottom' formation and growing institutional interest. The possibility of a spot ETF approval further fuels bullish sentiment, suggesting a repeat of XRP's historical tenfold rallies during bull cycles.

Beyond passive holding, platforms like Arc Miner are offering leveraged returns through XRP mining contracts. The service claims to generate $5,800 daily for participants at current prices, emphasizing compliance with UK financial regulations and eco-friendly mining operations powered by renewable energy sources. Fund security remains a priority, with customer assets held in tier-one banking institutions.

XRP Price at Critical Juncture as Analyst Warns of Potential Sharp Decline

XRP's bullish trajectory faces a decisive test at the $2.70 support level, with technical indicators suggesting looming volatility. Crypto strategist StephIsCrypto identifies this price zone as the make-or-break threshold for maintaining upward momentum—a weekly close below would invalidate the current uptrend structure.

Market dynamics reveal conflicting signals. While Elliott Wave theory suggests one final push toward $4-$5 targets, bearish divergences on higher timeframes paint a concerning picture. "The $2.70 level isn't just psychological support—it's the load-bearing wall for this rally," the analyst observed, noting that sustained weakness below this level could trigger cascading liquidations.

Sentiment indicators flash warning signs as price action decouples from market enthusiasm, a historical precursor to trend reversals. The coming weeks will determine whether XRP can muster enough buying pressure to overcome these technical headwinds or succumb to a deeper correction.

XRP Price Struggles Amid Bearish Pressure, Key Support Levels in Focus

XRP's brief rally above $3 faltered as selling pressure reemerged, pushing prices back below critical resistance. The failed breakout signals potential downside risk, with traders now eyeing the $2.80-$2.90 support zone as a make-or-break level for the token's near-term trajectory.

Technical indicators paint a bearish picture—XRP remains trapped below both the 50-day and 26-day moving averages, while tepid volume suggests weak buying interest. The 100-day moving average failed to spark meaningful demand when tested, reinforcing the market's cautious stance.

Market structure shows sellers firmly in control, with downward-sloping moving averages creating headwinds for any bullish reversal attempts. The lack of follow-through after recent tests of higher levels underscores the fragile sentiment surrounding XRP.

Will XRP Price Hit 3?

Based on current technical and fundamental analysis, XRP has a reasonable chance of reaching $3 in the near term, though several factors will determine the timing and sustainability.

| Factor | Current Status | Impact on $3 Target |

|---|---|---|

| Price vs 20-day MA | $2.7843 (below MA) | Needs breakout above $2.9617 |

| Bollinger Upper Band | $3.1786 | Provides resistance target |

| MACD Momentum | Bullish (0.0846) | Supports upward movement |

| ETF Speculation | High (99% approval odds) | Positive catalyst |

| Key Support Level | $2.7449 (Bollinger Lower) | Critical for maintaining bullish structure |

BTCC financial analyst Olivia suggests, 'The $3 level is achievable if XRP maintains above key support and capitalizes on positive ETF developments. However, traders should watch for any breakdown below $2.74 that could trigger sharper declines.'